Service Tax is a form of tax which is levied on any service and is to be paid by the “provider” of the service to the Central Govt. at the rates in force. The provider of the service can in turn collect the tax form the recipient of his service.

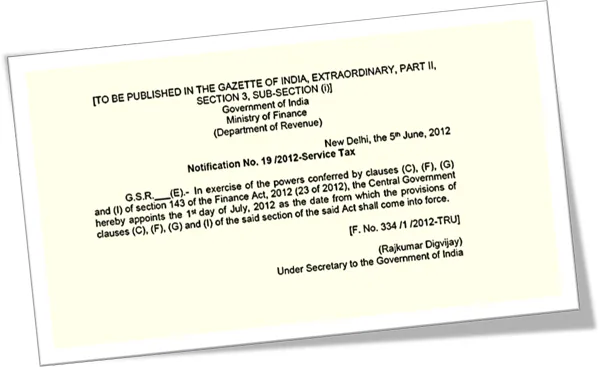

Starting July 1, 2012, India has shifted to the Negative List System which states that Service Tax would be levied on all services except the ones mentioned in the Negative List. Earlier, all services were exempt from Service Tax except those mentioned in the act.

The sale of advertising space or time slots is included under (G) Section 66D of Finance Act, 2012.

The sale of advertising space or time slots is included under (G) Section 66D of Finance Act, 2012.

Service Tax on Income from Advertisements

The educational guide on Service Tax, released by the Indian Ministry of Finance on June 20, 2012, mentions (page 35) that Service Tax is to be levied on the sale of space or time for advertisement to be broadcasted on radio or television. However, the notification also states that service tax is not to be levied on sale of space in print media, bill boards, buildings, cell phones, ATM Machines & Internet.

As the new service tax regime has specifically stated that Service Tax is not chargeable* on the sale of space for advertisements on the Internet, website owners and bloggers are exempted from paying Service Tax in India.

Update: We are only discussing service tax in this article, you still need to pay Income tax on online income from advertisement services like AdSense in India.

In case you have already paid Service Tax on online income from Google AdSense and other direct ad Sales, you can always claim refund of Service Tax.

Service Tax on Affiliate Income of Bloggers

The service tax is only exempted for advertising income but if you who are earning revenue though affiliate commissions (like Amazon Associates) or by providing other related services on the Internet, service Tax would be levied on all such services.

Moreover, service tax is levied on the Gross Amount Received rather than on the Net Income (i.e. Gross Amount – Expenses).

You can however claim Small Scale Service Provider exemption if the gross value of such services is less than Rs. 10 Lakhs. In other words, you are not required to pay any tax if the gross value of services provided by you is less than Rs. 10 Lakhs.

Also see: Calculate your Income Tax Liability on Online Income

Karan Batra is a visiting faculty member at Institute of Chartered Accountants of India and blogs at charteredclub.com.